Stagnating sales and declining order situation in the second quarter

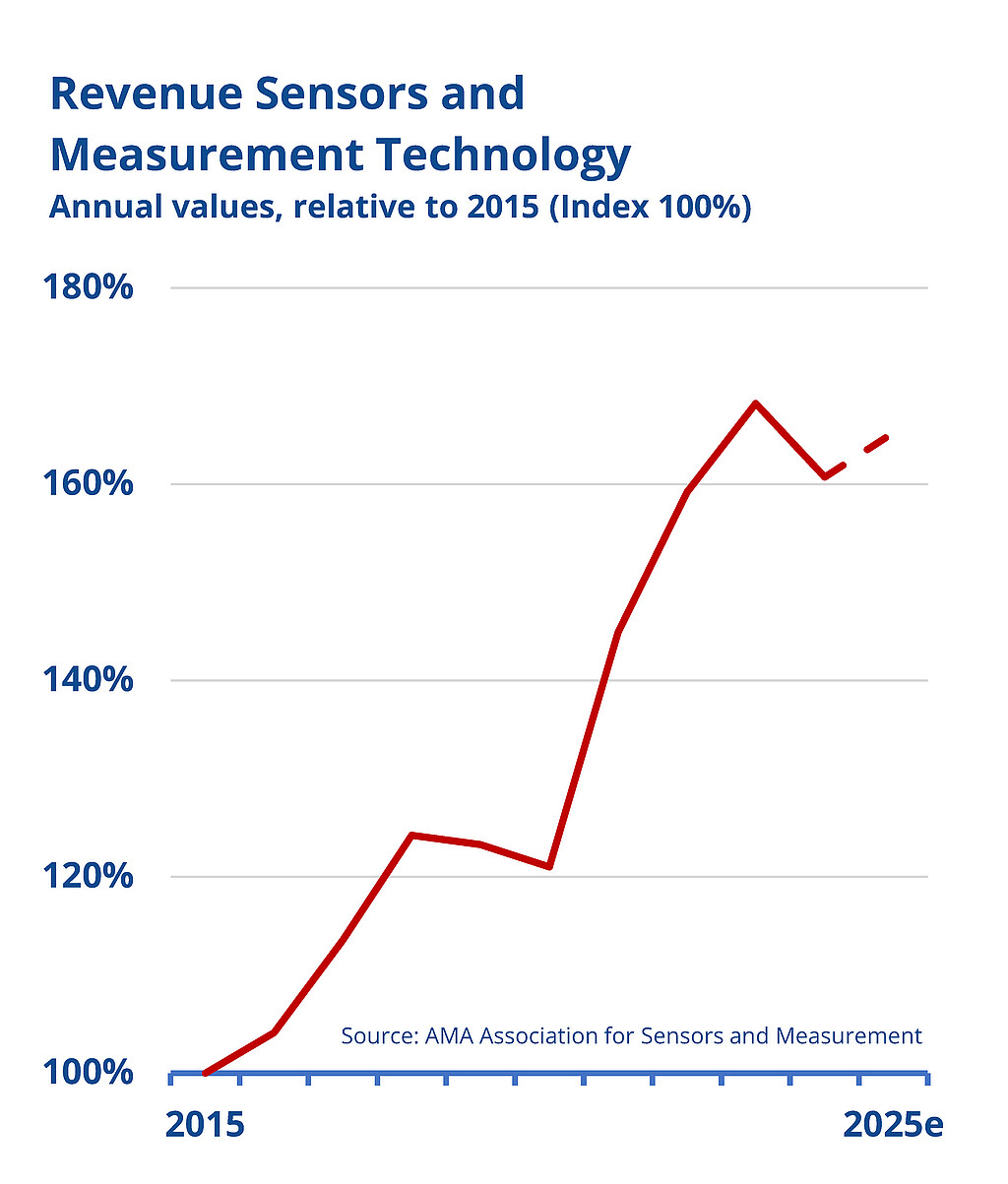

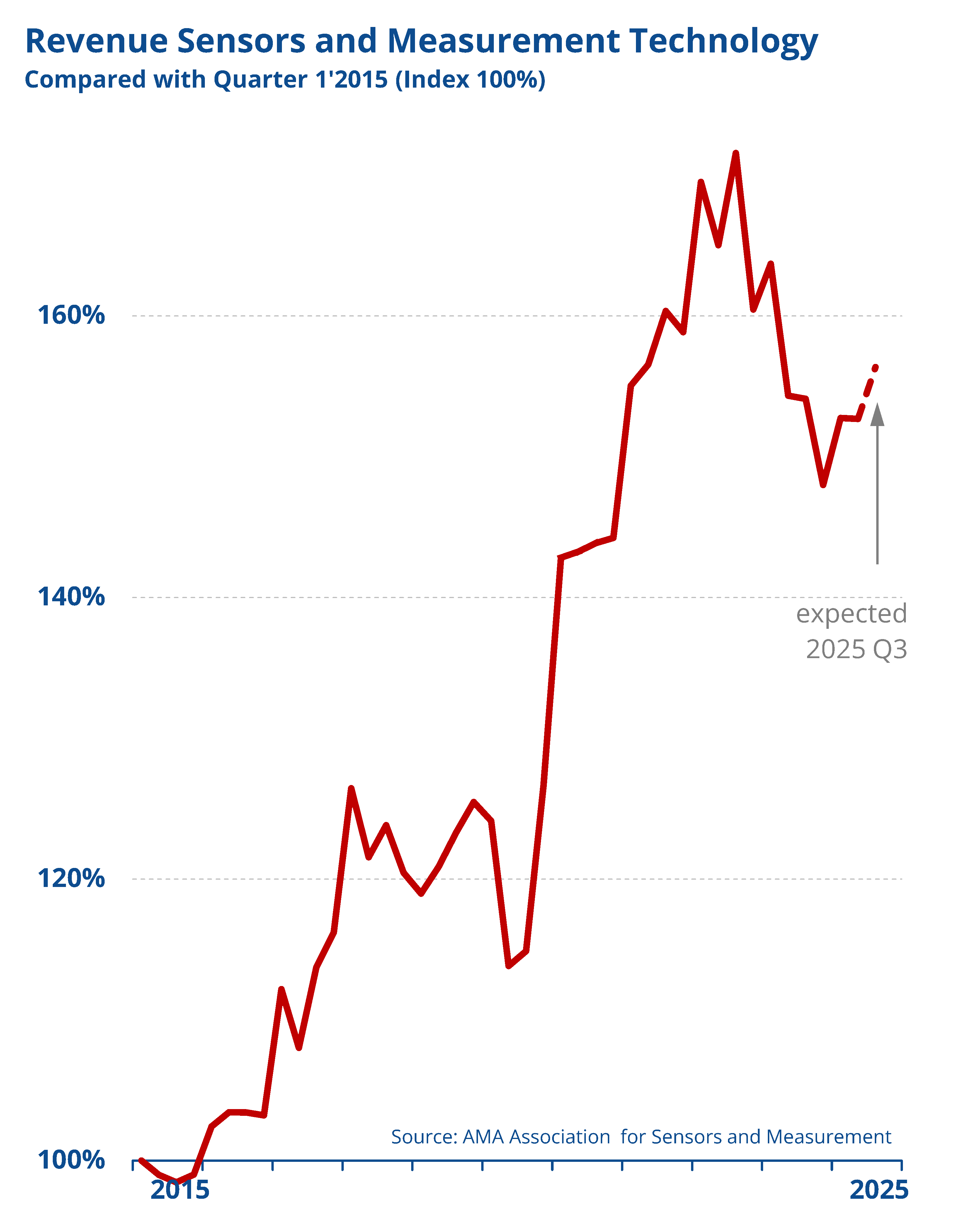

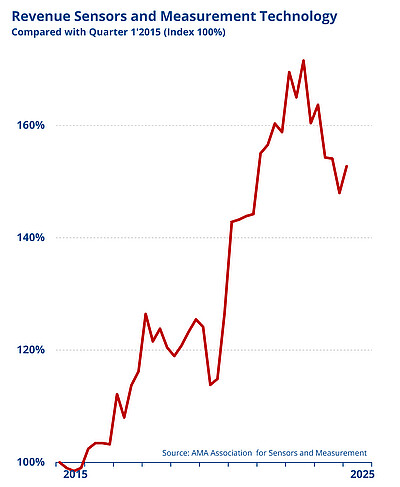

After a four percent increase in sales in the first quarter of 2025, sales in the industry remained unchanged in the second quarter compared to the previous quarter, while order intake declined by six percent. The slightly declining book-to-bill ratio of 0.96 signals a slight decline in orders in the second quarter. Nevertheless, the forecast for the third quarter of 2025 is for a moderate increase of two percent, with the industry benefiting from the higher order intake in the first quarter (up eleven percent).

Exports account for 56 percent of total sales. Within exports, Europe accounts for the largest share (34%), followed by North America (19%) and China (17%). This confirms the strong international networking of the industry.

According to the Federal Statistical Office, the picture is similar for the manufacturing sector in Germany as a whole: weak domestic demand, high energy prices, and geopolitical tensions are dampening order intake and production. Here, too, the book-to-bill ratio is below 1.0.

“The industry is in a phase of consolidation,” explains Philipp Gutmann, Managing Director of the AMA Association. “Stagnating sales and declining order intake make it clear that we need to step up our innovation and export strategies. We continue to see great opportunities in digitalization, automation, and artificial intelligence.”

The companies cited the following as the most important challenges:

· Trade barriers and export regulations (17%)

· Decline in demand in target markets (16%)

· Adaptation to regulatory requirements (15%)

In addition to economic indicators, the quarterly survey also highlights future topics such as the use of artificial intelligence (AI). Around one-third of companies (34%) use or plan to use AI, particularly in marketing and communication, followed by research and development (25%) and products and services (13%). These figures show that AI is increasingly perceived as a growth driver and field of innovation across the entire value chain of sensor and measurement technology.

Compared to the manufacturing industry as a whole, sensor and measurement technology companies continue to show a solid export orientation and are simultaneously focusing on innovative future technologies in order to tap into new growth potential.

Sensors and measurement technology show positive development in the first quarter of 2025

The AMA Association for Sensor and Measurement Technology reports positive economic development in the industry for the first quarter of 2025. The quarterly member survey revealed a three percent increase in sales compared to the previous quarter and a four percent increase compared to the first quarter of 2024. The increase in order intake was particularly pronounced, rising by 11 percent at the beginning of the year. This results in a book-to-bill ratio of 1.08, which indicates a healthy order situation.

Compared to the manufacturing sector as a whole, which according to the ifo Institute continues to suffer from weak demand, the sensor and measurement technology industry is stable. Despite economic uncertainties at the beginning of the year, the industry is holding its own thanks to its broad range of applications in almost all areas of society.

A look at the export figures underscores the international importance of the industry: 69 percent of AMA members export to North America, with 18 percent of total sales generated in the US, Canada, and Mexico. However, the announced increase in US import duties on EU goods is causing uncertainty. In view of possible trade barriers, the AMA Association is refraining from making any concrete forecasts on further developments.

“The results of our survey show that sensor and measurement technology make an important contribution in almost all areas of our society – this makes them more resilient to crises,” explains AMA Managing Director Philipp Gutmann. “Sensors remain a central building block for innovation and digitalization, but at the same time we are watching political developments in the North American market with concern.”

Sensor and Measurement Technology: Revenue Decline in Q4, Cautious Optimism for 2025

Sensor and measurement technology: decline in fourth quarter, cautious optimism for 2025

The sensor and measurement technology industry recorded a four percent decline in sales in the fourth quarter of 2024 compared to the previous quarter. Compared to the same period of the previous year, the decline was even more pronounced at eight percent. Incoming orders remained stable, but companies are still cautiously optimistic about 2025 and expect sales to grow by three percent.

Exports showed a positive trend: the export ratio rose by eight percentage points to 56 percent in 2024. While exports to Central European countries fell slightly, international sales markets developed unevenly.

Investments in 2024 remained at the previous year's level, and companies are planning a moderate increase of two percent for 2025 – a sign of long-term competitiveness. Despite geopolitical uncertainties, the industry is focusing on innovations and strategic investments.

“The sensor and measurement technology industry is confident despite economic fluctuations,” says Thomas Simmons, managing director of the AMA Association. ”Our members are making targeted investments in the future to remain competitive in the long term.”